Calibre11

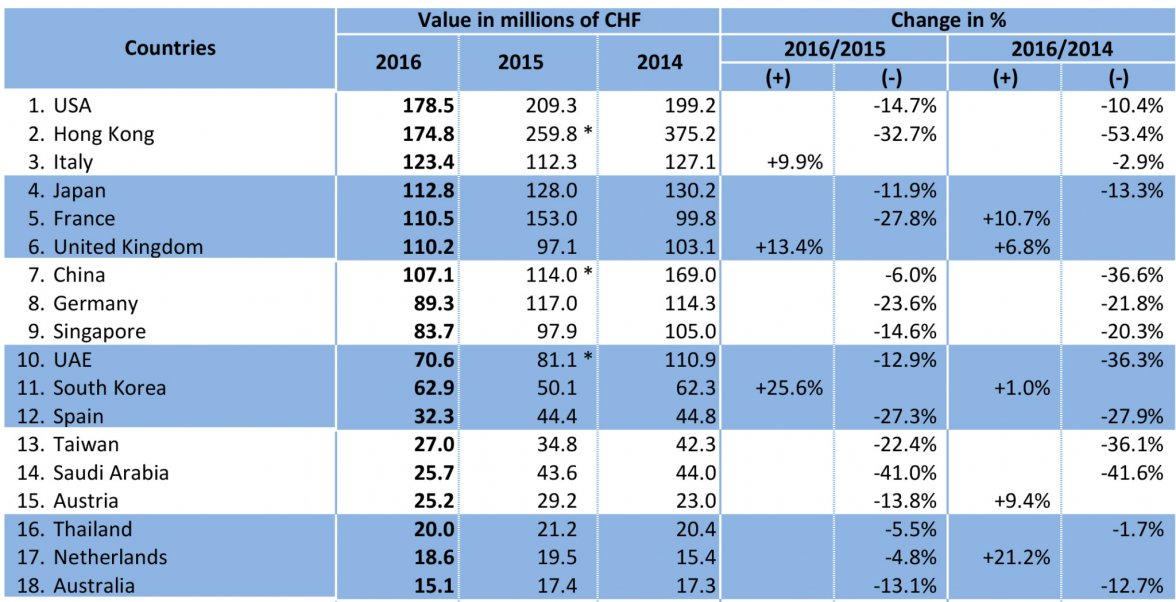

·There's been a lot of talk about the most recent sales results for the Swiss watch makers- in short, another reduction in sales- you can see the breakdown by market below

Source: http://www.watchpro.com/british-luxury-watch-market-on-fire-as-imports-from-switzerland-surge-13-4/

Some big falls in markets driven by tourism (Hong Kong and France- for very different reasons), with UK sales surging off the back of the reduction in the pound post Brexit.

So what does all this mean? Well, a few thoughts:

- TAG Heuer are very well placed in the changing market, given their focus on reducing their costs 2 years ago and largely exiting the $8-12K market

- We're already seeing a brace of new steel models from brands such as Piaget, who are looking to get some models in below the USD10k mark- it's a tough market to be only selling precious metal

- Swatch Group has started discussions with Swiss regulators to allow them to sell more movements to third parties...yes, sell MORE movements . The reduction in demand for movements has hit their movement business, so now they are changing their tune on third-party sales 😉

- We've seen a couple of watch companies being sold this year, including Frederique Constant and Glycine

- As I've mentioned in a previous post, I reckon the danger place for brands are those focused on the $8000-15000 price range.

Is this the beginning of a new crisis? Too early to say yet, but pleasingly from a TAG Heuer perspective, the brand seems to be well placed and with growing sales.

Source: http://www.watchpro.com/british-luxury-watch-market-on-fire-as-imports-from-switzerland-surge-13-4/

Some big falls in markets driven by tourism (Hong Kong and France- for very different reasons), with UK sales surging off the back of the reduction in the pound post Brexit.

So what does all this mean? Well, a few thoughts:

- TAG Heuer are very well placed in the changing market, given their focus on reducing their costs 2 years ago and largely exiting the $8-12K market

- We're already seeing a brace of new steel models from brands such as Piaget, who are looking to get some models in below the USD10k mark- it's a tough market to be only selling precious metal

- Swatch Group has started discussions with Swiss regulators to allow them to sell more movements to third parties...yes, sell MORE movements . The reduction in demand for movements has hit their movement business, so now they are changing their tune on third-party sales 😉

- We've seen a couple of watch companies being sold this year, including Frederique Constant and Glycine

- As I've mentioned in a previous post, I reckon the danger place for brands are those focused on the $8000-15000 price range.

Is this the beginning of a new crisis? Too early to say yet, but pleasingly from a TAG Heuer perspective, the brand seems to be well placed and with growing sales.